Feeds have been designed for flexibility to accommodate the full range of re/insurance industry use cases.

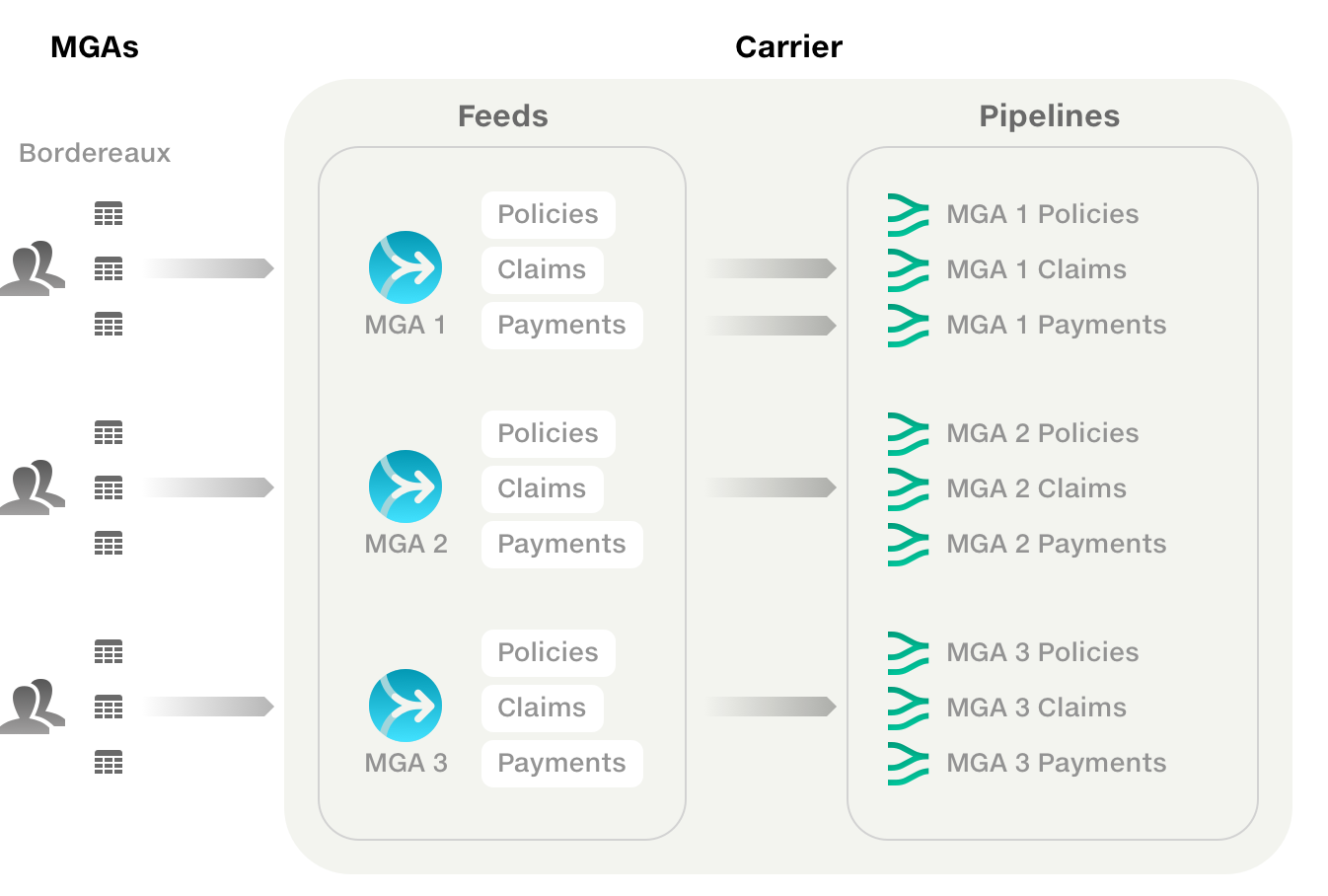

A capacity provider requests monthly bordereaux for premium and claims from 50 MGA partners.

When bordereaux are due an automatic data request is sent to each MGA. Once the MGAs have submitted their data, it is automatically validated, cleansed and restructured ready for use in the insurers risk management and financial reporting systems.

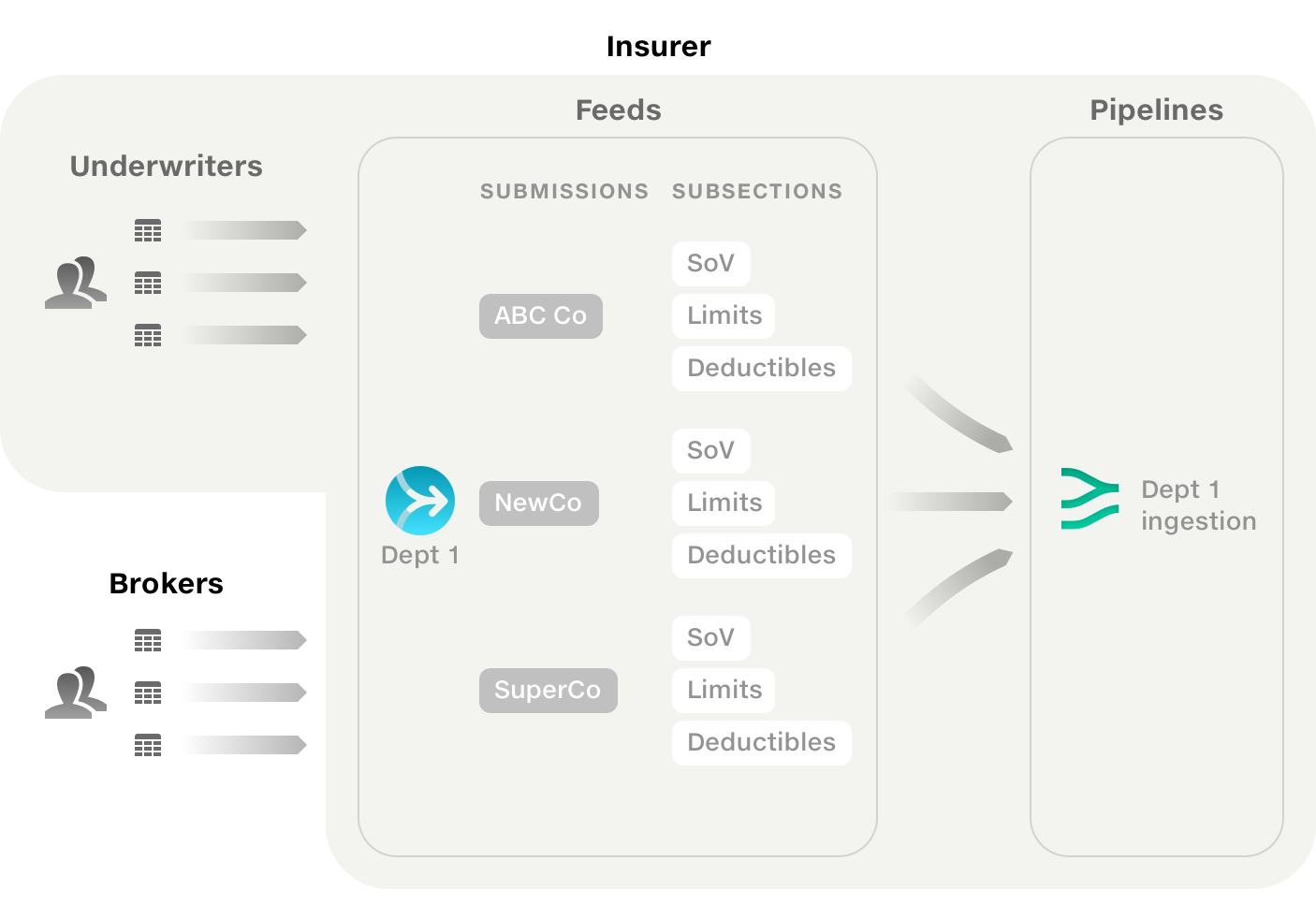

An insurer processes Schedules of Values (SoVs) for a property book, to feed risk and pricing models. The SoVs comprise three parts which must be processed separately: SoV, Limits, Deductibles.

When the risk data is available, it is uploaded to the relevant submission by the insurer (or directly by the broker if the insurer wishes). The uploader assigns each component to the correct subsection. These are fed through automatically to the correct pipeline stages.

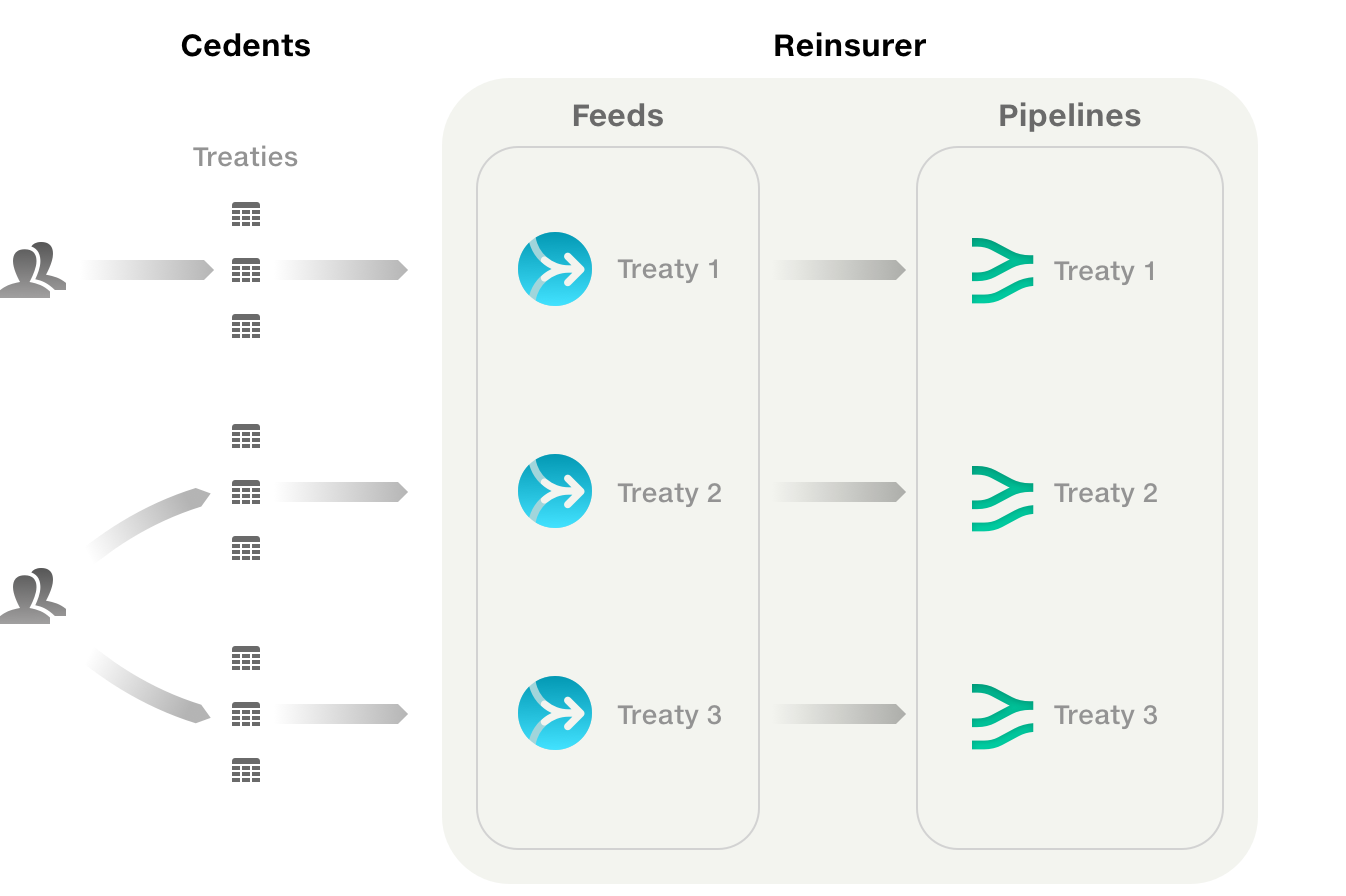

A reinsurer receives monthly data from numerous treaties across multiple cedents. Each treaty operates for a fixed period of time.

Each reporting period the treaty data requests are sent to the cedents in line with the schedule. When the cedents submit data, it is automatically fed through to a pipeline for that treaty. When the treaty expires, the cedent no longer receives requests.

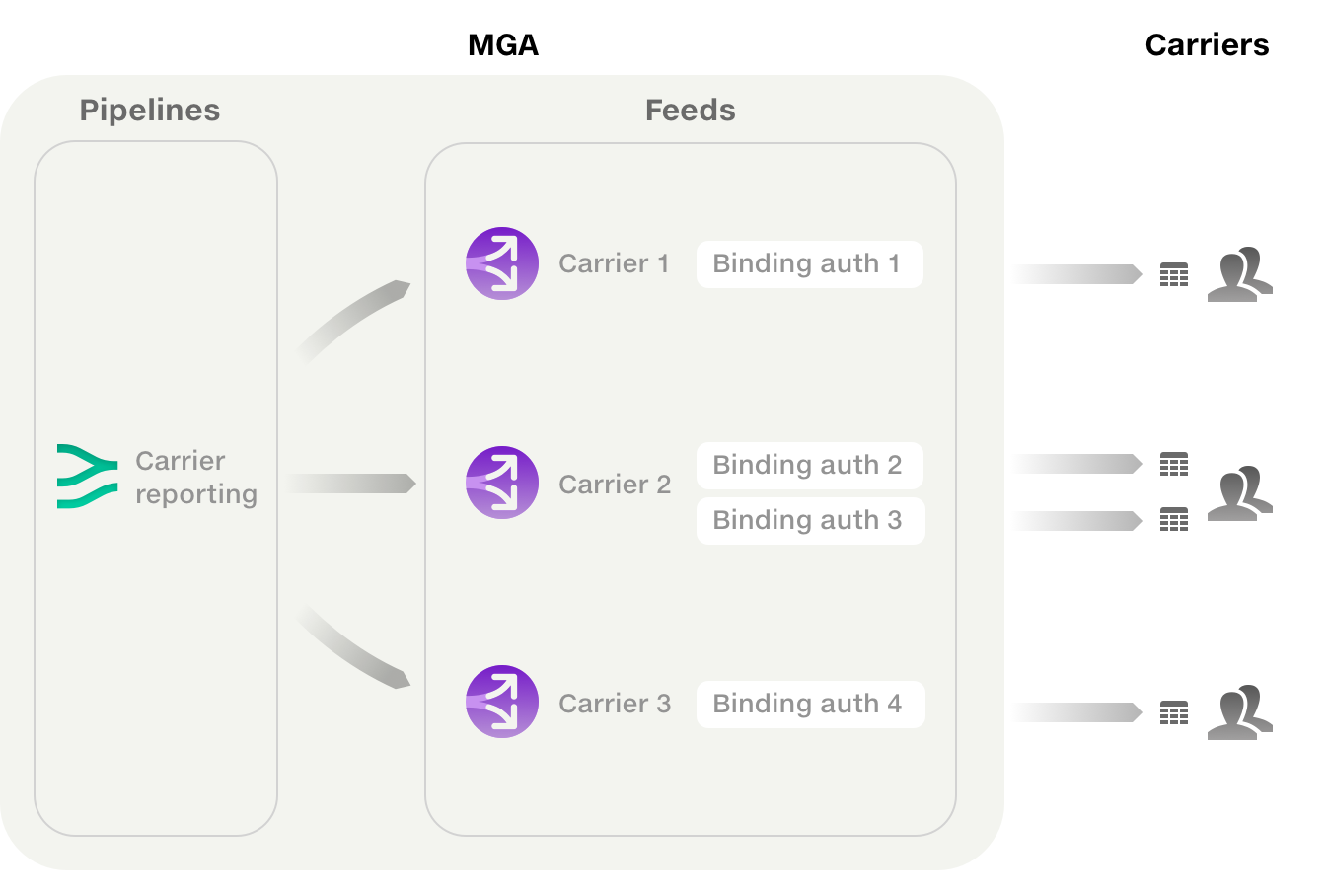

An MGA has multiple carriers supporting the same binding authority and each carrier requests different risk data and details of their share on every declaration.

When the reporting day arrives the pipeline automatically runs and sends the personalised data to each of the corresponding carriers.

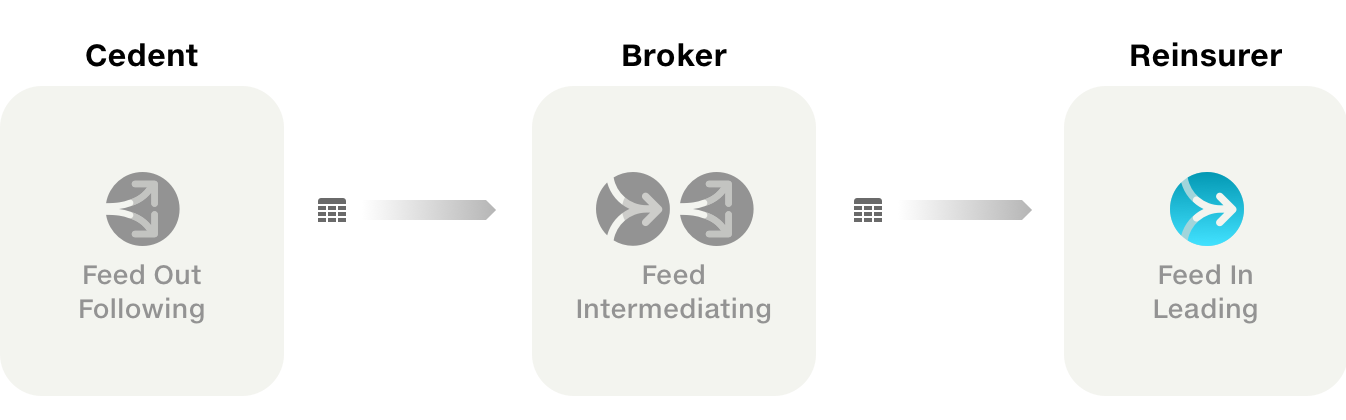

A reinsurer requesting bordereaux under a treaty will contact the placing broker for the data. In turn the broker must obtain the information from the ceding company.

When the data is submitted by the cedent and received by the broker a copy of the data is automatically passed to the reinsurer with all parties retaining full access to the data, including any further revisions made through a resubmission request.